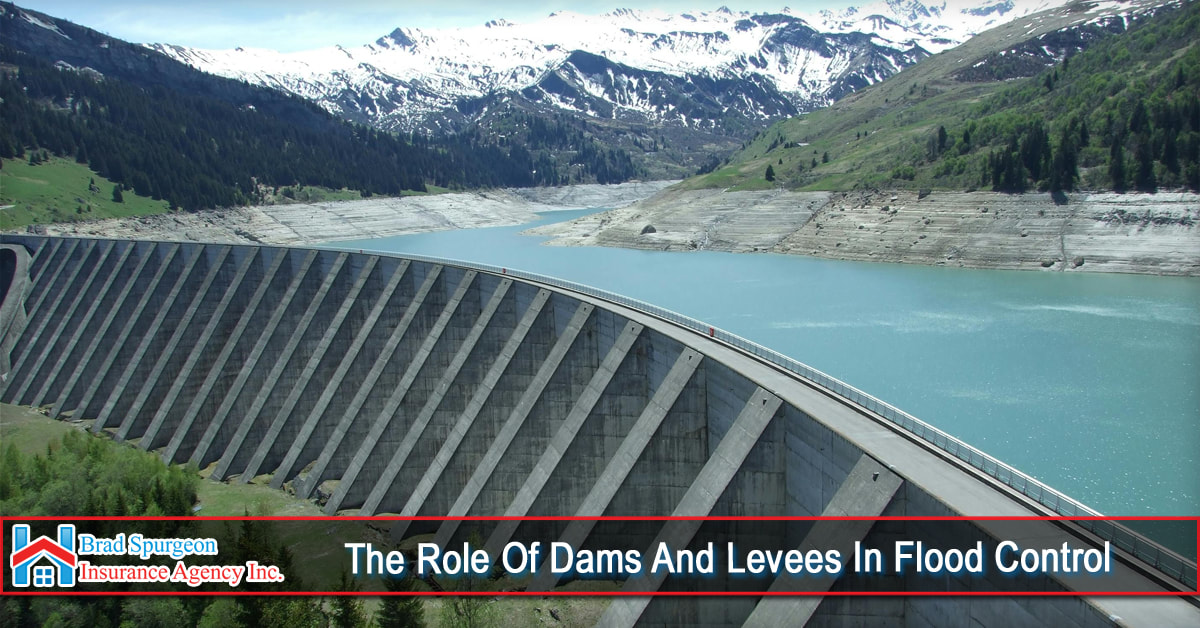

Dams are structures built across rivers and streams to control water flow and store excess water during heavy rainfall or snowmelt. They serve several essential functions in flood control:

- Water Storage: Dams can store large quantities of water, reducing the risk of downstream flooding during periods of heavy precipitation. This stored water can be released in a controlled manner, preventing sudden surges downstream.

- Regulating River Flow: By regulating the release of water, dams can help maintain a consistent and manageable flow rate in rivers, reducing the risk of flooding during heavy rain events.

- Hydropower Generation: Many dams are also equipped with hydropower facilities, which generate clean energy while contributing to flood control efforts.

While dams are valuable flood control assets, it's important to note that their failure can lead to catastrophic flooding. Proper maintenance and monitoring are crucial to ensure their effectiveness.

Levees: The Protective Barriers

Levees are embankments or walls built along riverbanks or coastlines to prevent water from overflowing into populated areas. They act as protective barriers against rising water levels and storm surges. Key functions of levees in flood control include:

- Containment: Levees contain floodwaters within their designated channels, keeping them away from homes, businesses, and agricultural lands.

- Storm Surge Defense: In coastal areas, levees are essential for protecting against storm surges caused by hurricanes or tropical storms.

- Erosion Prevention: Levees also help prevent erosion of riverbanks and shorelines during flooding.

Flood Insurance: A Crucial Safety Net

While dams and levees play a significant role in flood control, they are not infallible. Failures, breaches, or unexpected events can still lead to flooding. This is where flood insurance comes into play. Here's why it's crucial:

- Financial Protection: Flood insurance provides financial protection for homeowners and businesses against flood-related damage. It covers repair and replacement costs for structures and belongings damaged by flooding.

- Peace of Mind: Knowing that you have flood insurance can provide peace of mind, especially if you live in a flood-prone area. You can focus on preparedness and safety without worrying about the financial consequences of a flood.

- Mandatory in High-Risk Areas: For properties located in high-risk flood zones and secured with mortgages from federally regulated lenders, flood insurance is often mandatory.

- Recovery Assistance: After a flood event, navigating the recovery process can be complex. Flood insurance providers can assist with claims, making the recovery process smoother.

In conclusion, dams and levees are integral components of flood control efforts, helping to reduce the risk of flooding and protect communities. However, they are not foolproof, and the unpredictability of weather and water levels means that having flood insurance is essential for homeowners and business owners in flood-prone areas. It provides financial security and ensures that you can recover from flood-related damages and losses effectively. Consult with your insurance provider to understand your flood insurance options and secure the coverage you need for peace of mind during flood events.

At Brad Spurgeon Insurance Agency Inc., we aim to provide comprehensive insurance policies that make your life easier. We want to help you get insurance that fits your needs. You can get more information about our products and services by calling our agency at (409) 945-4746. Get your free quote today by CLICKING HERE.

Disclaimer: The information presented in this blog is intended for informational purposes only and should not be considered as professional advice. It is crucial to consult with a qualified insurance agent or professional for personalized advice tailored to your specific circumstances. They can provide expert guidance and help you make informed decisions regarding your insurance needs.