|

Windstorm disasters, such as hurricanes, tornadoes, and severe storms, can cause extensive physical damage, but their impact goes far beyond the visible destruction. These events can have profound social and psychological effects on individuals and communities. Understanding these impacts is essential for developing effective support systems and recovery strategies. This article explores the various ways windstorm disasters affect mental health, social dynamics, and the importance of windstorm insurance in mitigating these effects.

0 Comments

Windstorms are powerful weather events characterized by strong winds that can cause significant damage to property and infrastructure. From minor gusts to catastrophic cyclones, windstorms come in various forms and intensities, posing threats to communities worldwide. Understanding the different types of windstorms is essential for preparedness and mitigation efforts. In this blog, we'll explore the various types of windstorms, their characteristics, and the importance of being informed and proactive in dealing with these natural phenomena.

In regions prone to strong winds and windstorms, the resilience of buildings becomes a top priority. Constructing structures that can withstand the force of powerful gusts not only protects property and lives but also reduces the need for costly repairs and replacements. In this article, we'll explore the principles of windstorm-resistant architecture, the importance of building for gusts, and how Windstorm Insurance factors into this critical equation.

Hurricane season can be a time of heightened anxiety and uncertainty for homeowners in coastal and hurricane-prone regions. While preparing for hurricanes often involves securing your property and stocking up on essential supplies, one critical aspect that should not be overlooked is windstorm insurance. In this blog, we'll explore the importance of windstorm insurance during hurricane season and how it can provide essential protection for your home and peace of mind for you and your family.

Urban Heat Islands (UHIs) are areas within cities that experience significantly higher temperatures than their surrounding rural areas due to human activities and the built environment. These heat islands can have a profound impact on the well-being of urban residents and the environment. One factor that exacerbates the effects of UHIs is windstorms. In this blog, we'll explore the relationship between windstorms and urban heat islands and discuss how this connection can be relevant to Windstorm Insurance considerations.

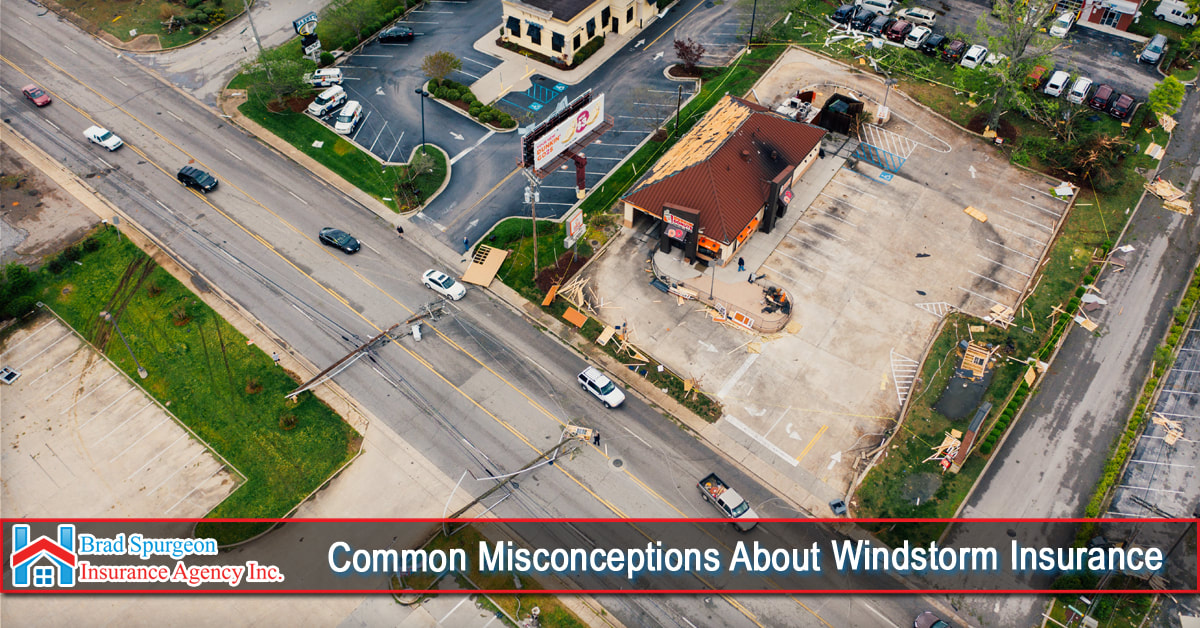

Windstorms, including hurricanes and tornadoes, can cause significant damage to homes and properties. To mitigate the financial impact of such events, many homeowners opt for windstorm insurance. However, there are several misconceptions surrounding this type of coverage. In this blog, we'll address some of the common misconceptions about windstorm insurance and provide accurate information to help you make informed decisions regarding your coverage.

In the world of Windstorm Insurance, accurate forecasting and tracking of severe weather events like hurricanes are paramount. Forecasters and researchers must continually monitor tropical cyclones to gain a deeper understanding of their behavior. One essential aspect of this monitoring process involves real-time lightning data, which plays a significant role in assessing the evolution of these storms.

Windstorms are powerful natural phenomena that can cause significant damage to properties and disrupt lives. To effectively prepare for and protect against windstorms, it's crucial to understand how these destructive weather events form and the forces at play. In this blog, we will delve into the science of windstorm formation, shedding light on the key factors that contribute to their development. Additionally, we will explore how windstorm insurance can provide financial security in the face of these formidable events.

In recent years, the increasing frequency of severe weather events has underscored the importance of understanding the limitations of your homeowner's insurance policy. While your standard insurance typically covers damages from various sources, it's essential to consider the need for separate windstorm insurance, especially if you reside in an area prone to tropical storms and tornadoes. Let's delve deeper into the world of windstorm insurance to help you make informed decisions.

A gentle breeze on a hot day can be refreshing, making you feel like you're at a beachside vacation spot. However, the serenity of a light breeze can quickly transform into a destructive force when it evolves into a storm. That's where windstorm insurance steps in to provide crucial protection for your home.

|

Archives

June 2024

Categories

All

|