My Homeowners Insurance Covers Wind Damage

One of the most prevalent misconceptions is that standard homeowners insurance covers all types of wind damage. While homeowners insurance typically covers wind damage from common storms, it may exclude coverage for windstorms associated with hurricanes or tornadoes. To protect against these specific perils, you need a separate windstorm insurance policy.

Misconception #2:

Windstorm Insurance Is Expensive

Another misconception is that windstorm insurance is prohibitively expensive. The cost of windstorm insurance varies depending on factors such as your location and the value of your home. While it can be relatively costly in high-risk areas, the protection it provides in the event of a windstorm-related loss can be invaluable.

Misconception #3:

Windstorm Insurance Is Only for Coastal Areas

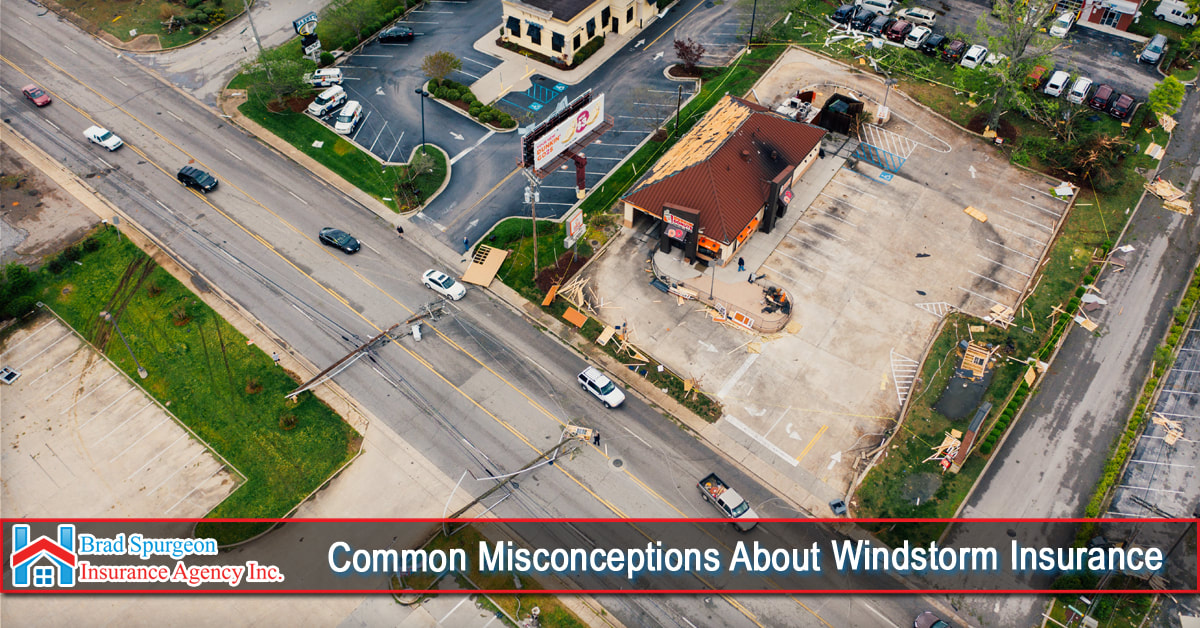

Some homeowners mistakenly believe that windstorm insurance is only necessary for properties located near the coast. While coastal areas are indeed at higher risk, windstorms can occur inland as well. Depending on your region's susceptibility to windstorms, it may be advisable to consider windstorm insurance regardless of your proximity to the coast.

Misconception #4:

All Windstorm Insurance Policies Are the Same

Not all windstorm insurance policies are created equal. Different insurance providers offer varying levels of coverage and policy terms. It's essential to carefully review the terms and conditions of a windstorm insurance policy to understand what is covered and what is not. Consider factors such as deductibles, coverage limits, and additional endorsements or riders.

Misconception #5:

Windstorm Insurance Covers All Wind-Related Damage

Windstorm insurance typically covers direct wind damage to your home, such as roof damage, structural damage, and damage to personal property caused by wind. However, it may not cover indirect damage, such as flooding that results from a storm surge or heavy rainfall. For comprehensive protection, homeowners may need to consider additional coverage like flood insurance.

Misconception #6:

I Don't Need Windstorm Insurance Because I Have a Hurricane Deductible

While some homeowners may have a hurricane deductible as part of their standard homeowners policy, it's important to note that it doesn't replace the need for specific windstorm insurance. Hurricane deductibles typically apply to hurricane-related wind damage and may have different terms and conditions than a dedicated windstorm insurance policy.

In Conclusion

Windstorm insurance is a valuable form of protection for homeowners in areas prone to windstorms, hurricanes, and tornadoes. It helps safeguard your property and finances in the event of wind-related damage. To make informed decisions about windstorm insurance, it's crucial to dispel common misconceptions and understand the specifics of your coverage. Consult with an experienced insurance agent to assess your risk and select the right policy to ensure you have adequate protection against windstorm-related losses. Don't let misconceptions about windstorm insurance leave you underprepared when a severe wind event occurs.

At Brad Spurgeon Insurance Agency Inc., we aim to provide comprehensive insurance policies that make your life easier. We want to help you get insurance that fits your needs. You can get more information about our products and services by calling our agency at (409) 945-4746. Get your free quote today by CLICKING HERE.

Disclaimer: The information presented in this blog is intended for informational purposes only and should not be considered as professional advice. It is crucial to consult with a qualified insurance agent or professional for personalized advice tailored to your specific circumstances. They can provide expert guidance and help you make informed decisions regarding your insurance needs.