When it comes to auto insurance, there’s one term you’ve likely encountered but may not fully understand: the deductible. While it may seem like just another line item in your policy, the deductible plays a key role in both your coverage and your premium. Understanding how it works—and how to manage it—can help you save money and make more informed decisions about your car insurance.

In this article, we’ll break down what an auto insurance deductible is, how it affects your premiums, and provide tips for selecting the right deductible to fit your needs.

An auto insurance deductible is the amount of money you agree to pay out-of-pocket before your insurance coverage kicks in to cover the rest of the costs in the event of a claim. It’s a critical part of your policy and is usually tied to certain types of coverage, such as collision and comprehensive insurance.

For example, if you have a $500 deductible and you’re involved in a car accident that causes $3,000 worth of damage to your vehicle, you would pay the first $500, and your insurance company would cover the remaining $2,500 (minus any other applicable costs or fees).

Your deductible is one of the primary factors that influences the cost of your auto insurance premium, which is the amount you pay periodically (usually monthly, semi-annually, or annually) to maintain coverage. There’s a direct relationship between your deductible and your premium:

- Higher Deductible = Lower Premium

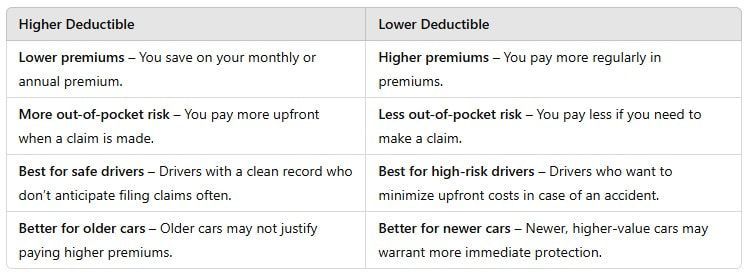

If you choose a higher deductible, your premium will generally be lower. This is because you’re assuming more of the financial risk. In the event of an accident or claim, you will pay more upfront before your insurance provider covers the rest. Insurance companies reward you for taking on a higher level of responsibility by lowering your monthly or yearly premium. - Lower Deductible = Higher Premium

Conversely, selecting a lower deductible means you’ll pay less out-of-pocket in the event of a claim. However, the trade-off is that your premium will be higher, as the insurance company is covering more of the risk. This is often a good option for drivers who want to minimize their out-of-pocket expenses in case of a claim but are willing to pay more in premiums for the peace of mind that comes with lower upfront costs.

While deductibles are commonly associated with collision and comprehensive coverage, there are specific types of coverage that may or may not have a deductible. Here’s a breakdown:

Collision coverage pays for damage to your vehicle resulting from a crash, regardless of who is at fault. A deductible is usually applicable here, and you will need to pay this amount before your insurer steps in to cover the rest of the repair or replacement costs.

Comprehensive coverage protects against damage to your car from incidents like theft, vandalism, fire, or natural disasters. Like collision coverage, comprehensive insurance typically comes with a deductible.

- Liability Insurance:

This coverage is for injuries and damages caused to others in an accident where you are at fault. It usually does not involve a deductible.

- Uninsured/Underinsured Motorist Coverage:

This coverage helps protect you if you’re hit by a driver who doesn’t have enough insurance or any insurance at all. There’s typically no deductible for this coverage in most states.

- Medical Payments or Personal Injury Protection (PIP): This coverage helps pay for medical expenses if you're injured in an accident, regardless of fault. It often doesn’t have a deductible, depending on the policy.

Selecting the right deductible is about balancing your comfort level with risk and what you can afford. Here are a few factors to consider when deciding what deductible is best for you:

When selecting a higher deductible, consider whether you can comfortably afford to pay that amount out-of-pocket in the event of a claim. A higher deductible may lower your premium, but if you have an accident and need to pay the deductible, it could be a financial strain. Make sure that the deductible you choose fits within your budget and that you have enough savings to cover it in case of an emergency.

If you have a clean driving record and drive safely, you may not need to file a claim often. In this case, opting for a higher deductible could be a good strategy for saving on premiums. However, if you tend to drive in areas with heavy traffic, poor road conditions, or if you're worried about the possibility of accidents, a lower deductible might offer more peace of mind.

For older or lower-value cars, a higher deductible might be a good choice because the cost of repairs or replacement may not justify a high premium. On the other hand, if you drive a newer, more expensive car, it might make sense to choose a lower deductible to ensure that in the event of an accident, you aren’t left with a significant out-of-pocket cost for repairs.

Choosing a higher deductible means taking on more of the financial responsibility in case of an accident. This works well for people who are risk-tolerant and prefer to save on premiums. However, if the thought of paying a higher deductible is stressful, it might be worth opting for a lower deductible, even if it means paying higher premiums.

Understanding your auto insurance deductible is essential in managing your policy and balancing the cost of coverage. By choosing the right deductible, you can make a significant difference in your premium payments while ensuring you have the protection you need. Whether you opt for a higher deductible to save on premiums or a lower one for peace of mind, the key is finding a balance that suits your driving habits, risk tolerance, and financial situation.

Take the time to assess your needs, consider your budget, and shop around for policies with varying deductibles. By doing so, you’ll be able to maximize your coverage while minimizing your costs in a way that works best for your unique circumstances.

At Brad Spurgeon Insurance Agency Inc., we aim to provide comprehensive insurance policies that make your life easier. We want to help you get insurance that fits your needs. You can get more information about our products and services by calling our agency at (409) 945-4746. Get your free quote today by CLICKING HERE.

Disclaimer: The information presented in this blog is intended for informational purposes only and should not be considered as professional advice. It is crucial to consult with a qualified insurance agent or professional for personalized advice tailored to your specific circumstances. They can provide expert guidance and help you make informed decisions regarding your insurance needs.