Flooding has always been a natural part of weather cycles, but in recent years, the frequency and severity of flood events have increased dramatically. Climate change is reshaping weather patterns, raising sea levels, and contributing to more powerful storms. All of this has made flooding one of the most significant environmental and financial threats facing homeowners today. Understanding how climate change affects flood risks—and what you can do to prepare—can help protect your home, your property, and your peace of mind.

How Climate Change Is Increasing Flood Risk

Climate change influences weather systems in multiple ways that contribute to flooding:

1. Rising Sea Levels

As global temperatures increase, glaciers and ice sheets melt, causing sea levels to rise. Communities along coastlines are now more vulnerable to:

- Higher storm surge

- Permanent erosion

- Coastal flooding during high tides

2. Stronger and More Frequent Storms

Warmer ocean temperatures fuel stronger hurricanes and tropical storms that carry more moisture. This means:

- Heavier rainfall over short periods

- Increased flash flooding

- Greater storm intensity and damage potential

3. Shifts in Seasonal Weather Patterns

Some regions are experiencing more extreme rainfall during certain seasons, while others experience prolonged dry spells followed by sudden heavy rain—both of which exacerbate flood risks.

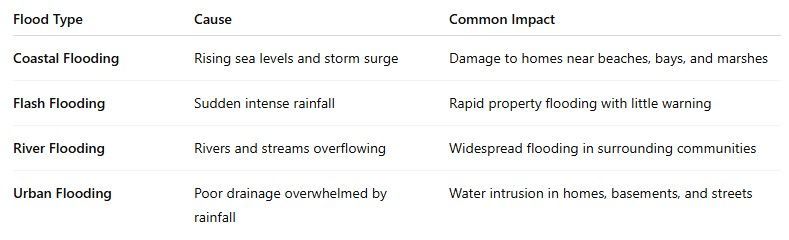

Types of Flooding Homeowners May Face

Not all flooding looks the same. Climate change is contributing to different forms of flooding in urban and rural environments:

Local Flood Risk Awareness

Flood vulnerability can vary greatly by region. For example, homeowners in Texas City, TX may experience increased flooding risk due to coastal proximity, seasonal storms, and the impact of rising sea levels along the Gulf Coast. Staying informed about local weather trends and flood maps is a key part of protecting your home.

How to Assess Your Home’s Flood Risk

You can evaluate flood exposure using several strategies:

1. Check FEMA Flood Maps

These maps show flood hazards and help determine whether your home is in a high-risk zone.

2. Review Local Flood History

Ask neighbors, community leaders, or local government agencies about flood events in your area.

3. Consider Your Property Layout

Low-lying areas, poor drainage, and nearby water sources can increase risk.

4. Pay Attention to Weather Pattern Changes

More frequent storms or heavier rainfall could mean rising future risk.

Steps to Reduce Flood Damage

While you cannot prevent flooding, you can reduce the impact:

- Install flood vents and sump pumps

- Elevate HVAC systems and electrical panels

- Use water-resistant building materials when renovating

- Keep landscaping graded to direct water away from your home

- Store important documents in waterproof and fireproof containers

Even small improvements can significantly reduce damage and repair costs.

Why It’s Important to Have Flood Insurance

Flood insurance provides essential financial security in the event of flood-related damage—something standard homeowners insurance does not cover. Many families are surprised to learn this only after experiencing a flood.

Key Benefits of Flood Insurance

- Covers Repair Costs: Helps pay to repair or rebuild your home after flooding.

- Protects Personal Belongings: Can cover furniture, clothing, appliances, and valuables (depending on coverage type).

- Reduces Financial Stress: Flood repairs can be expensive—insurance prevents overwhelming out-of-pocket costs.

- Helps With Recovery: Insurance support speeds up the recovery and rebuilding process.

Who Flood Insurance Best Serves

- Homeowners in high-risk or coastal areas

- Buyers with mortgage requirements in flood zones

- Anyone near rivers, lakes, drainage basins, or low-lying neighborhoods

- Homeowners concerned about weather changes and future risk

If you live in a region where floods have become more frequent, flood insurance isn’t just an option—it’s a necessary layer of protection.

Conclusion

Climate change has reshaped how we think about flooding. The risk is growing, affecting coastal and inland communities alike. But with awareness, preparation, and the right insurance coverage, homeowners can safeguard their property and financial future.

Understanding your flood risk—and acting now—can make all the difference when the next storm arrives.

At Brad Spurgeon Insurance Agency Inc., we aim to provide comprehensive insurance policies that make your life easier. We want to help you get insurance that fits your needs. You can get more information about our products and services by calling our agency at (409) 945-4746. Get your free quote today by CLICKING HERE.

Disclaimer: The information presented in this blog is intended for informational purposes only and should not be considered as professional advice. It is crucial to consult with a qualified insurance agent or professional for personalized advice tailored to your specific circumstances. They can provide expert guidance and help you make informed decisions regarding your insurance needs.