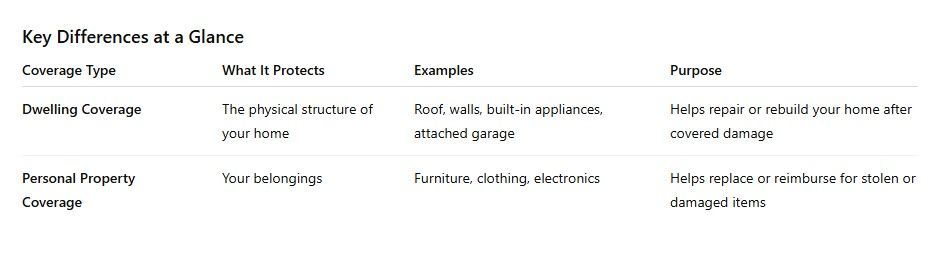

When reviewing your home insurance policy, you’ll often see two major coverage components: dwelling coverage and personal property coverage. While both are designed to protect your home and belongings, they each serve different purposes. Understanding the distinction helps ensure you’re fully protected in the event of damage, theft, or disaster.

Below, we break down what each type of coverage includes, how they work, and why both are essential parts of a well-rounded home insurance plan.

What Is Dwelling Coverage?

Dwelling coverage protects the structure of your home—the physical building itself. This includes the materials and features that make up your house.

Dwelling Coverage Typically Includes:

- The roof

- Exterior and interior walls

- Flooring and ceilings

- Built-in appliances (e.g., water heater, furnace)

- Attached structures such as:

- Garages

- Porches

- Decks

This coverage is designed to help pay for repairs or rebuilding if your home is damaged by covered events such as:

- Fire

- Lightning

- Hail

- Windstorm

- Vandalism

- Certain types of water damage

It does not cover: general wear and tear, poor maintenance, or damage caused by excluded hazards like flooding (unless you add separate flood insurance).

What Is Personal Property Coverage?

Personal property coverage protects your belongings, not the house itself. If you could pick it up and take it when you move, it’s generally covered under personal property insurance.

Personal Property Coverage Typically Includes:

- Furniture and décor

- Clothing and footwear

- Electronics (TVs, laptops, gaming systems)

- Kitchen appliances and cookware

- Tools and lawn equipment

- Jewelry and collectibles (often with coverage limits unless scheduled separately)

This coverage helps reimburse you if your items are damaged or stolen—whether they were inside your home, in your car, or sometimes even while traveling.

Personal property claims are often based on either:

- Actual Cash Value (ACV): depreciated value at the time of loss

- Replacement Cost Value (RCV): cost to replace the item with a new one

Make sure you know which applies to your policy.

Why Both Types of Coverage Matter

Having only dwelling coverage would leave your personal belongings unprotected in the event of a fire or theft.

Having only personal property coverage would leave you financially responsible for repairing your home after severe damage.

The best protection comes from having both, at limits that reflect real replacement values.

Local Note for Texas Homeowners

For homeowners in Texas City, TX, where weather events such as tropical storms and wind-related damage can occur, it’s especially important to review both dwelling and personal property coverage closely to ensure your home and belongings are properly insured.

Tips to Ensure You’re Adequately Covered

1. Review Your Coverage Limits

Make sure the coverage amount reflects current construction and replacement costs.

2. Conduct a Home Inventory

List and photograph items to make claim filing faster and more accurate.

3. Consider Replacement Cost Coverage

It can provide more complete reimbursement than depreciated value coverage.

4. Ask About Special Coverage for High-Value Items

Jewelry, fine art, and collectibles may require additional scheduled coverage.

Final Thoughts

Dwelling and personal property coverage are the foundation of a strong home insurance policy. While dwelling coverage protects the physical home itself, personal property coverage protects your belongings inside it. Understanding how each works ensures you can make informed decisions—and avoid unexpected financial hardship after a loss.

Taking the time now to review your policy, evaluate your coverage levels, and update your inventory can help you feel prepared and confident—knowing your home and everything in it are well-protected.

At Brad Spurgeon Insurance Agency Inc., we aim to provide comprehensive insurance policies that make your life easier. We want to help you get insurance that fits your needs. You can get more information about our products and services by calling our agency at (409) 945-4746. Get your free quote today by CLICKING HERE.

Disclaimer: The information presented in this blog is intended for informational purposes only and should not be considered as professional advice. It is crucial to consult with a qualified insurance agent or professional for personalized advice tailored to your specific circumstances. They can provide expert guidance and help you make informed decisions regarding your insurance needs.