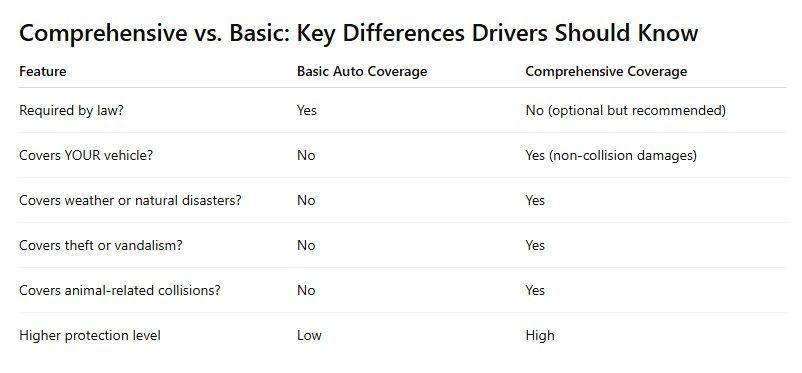

Choosing the right auto insurance isn’t just about meeting legal requirements—it’s about protecting your vehicle, your finances, and your peace of mind. Many drivers only carry the minimum coverage required by their state, not realizing how vulnerable they still are to unexpected accidents, theft, weather events, and everyday mishaps.

Understanding the difference between basic auto coverage and comprehensive coverage is essential for making an informed decision. Whether you're a new driver, a seasoned commuter, or someone reviewing their policy in a coastal city like Texas City, TX, knowing what each policy includes helps ensure you’re never caught off guard.

What Is Basic Auto Coverage?

Basic auto insurance typically includes only the minimum coverage required by state law. While this keeps premiums lower, it provides limited protection.

Common Components of Basic Auto Coverage

1. Liability Insurance

Covers damage or injuries you cause to others.

- Bodily Injury Liability: Medical costs for injured parties

- Property Damage Liability: Repairs to the other driver’s vehicle or property

2. Personal Injury Protection (PIP) or Medical Payments

Depending on your state, this may cover:

- Medical bills

- Lost wages

- Certain rehabilitation expenses

3. Uninsured/Underinsured Motorist Coverage

Protects you if the at-fault driver has no insurance or not enough coverage.

What basic coverage DOES NOT cover:

- Damage to your vehicle

- Theft

- Vandalism

- Weather-related damage

- Collision with animals

Drivers who rely solely on basic coverage often face large out-of-pocket expenses after an unexpected incident.

What Is Comprehensive Auto Coverage?

Comprehensive coverage is optional but highly recommended because it protects your vehicle from non-collision-related damage.

What Comprehensive Coverage Includes

- Theft and Vandalism

If your car is stolen or damaged intentionally. - Fire, Flood, and Natural Disasters

Critical for drivers in areas prone to storms or flooding—such as regions along the Gulf Coast and cities like Texas City, TX. - Falling Objects

Tree branches, debris, or other impacts. - Weather Damage

Hail, windstorms, lightning, and more. - Animal Collisions

Coverage for hitting a deer or other wildlife. - Glass/Window Damage

Often includes or can be expanded to cover windshield repair or replacement.

Unlike basic coverage, comprehensive insurance helps pay for damage to your OWN vehicle—even when you're not driving.

Who Benefits Most from Comprehensive Coverage?

Comprehensive coverage is especially important if you:

- Live in an area prone to hurricanes, hail, flooding, or severe storms

- Park outdoors or on the street

- Drive a newer or high-value vehicle

- Want protection from theft, vandalism, or random accidents

- Cannot afford major out-of-pocket repair bills

In coastal cities like Texas City, TX, where weather risks and environmental conditions are more unpredictable, comprehensive auto insurance becomes a strong—and often essential—financial safeguard.

Why Drivers Shouldn’t Ignore the Added Protection

1. It Protects Your Investment

Vehicles are expensive. Comprehensive coverage keeps repair or replacement costs manageable.

2. Weather Can Cause Major, Unexpected Damage

Storms, hail, wind, and flooding are increasingly common—and expensive to repair.

3. Theft and Vandalism Are Always Possible

Even in safe neighborhoods, vehicle crimes happen. Comprehensive coverage ensures you’re not left to pay the full cost.

4. It Provides Peace of Mind

Knowing you’re protected from almost every non-collision scenario makes driving far less stressful.

5. It Helps Maintain the Value of Your Car

Without adequate protection, unrepaired damage can quickly reduce resale value.

How to Choose the Right Level of Coverage

- Evaluate Your Risks

Consider weather patterns, crime rates, and road conditions in your area. - Consider Your Vehicle’s Value

Newer and financed vehicles often require comprehensive coverage. - Review Your Budget

Weigh premium costs against potential repair expenses. - Check Lender Requirements

If your car is leased or financed, comprehensive coverage is often mandatory. - Speak With a Licensed Insurance Professional

An expert can help tailor a policy that fits your needs and budget.

Conclusion

While basic

auto insurance may meet legal requirements, it often falls short when it comes to protecting your vehicle and financial stability. Comprehensive coverage fills the gaps—covering theft, weather damage, vandalism, animal collisions, and many unexpected events that drivers can’t control.

Whether you drive daily through busy metropolitan areas or along the beautiful coastlines near Texas City, TX, investing in the right level of protection ensures you can handle the unexpected with confidence.

At Brad Spurgeon Insurance Agency Inc., we aim to provide comprehensive insurance policies that make your life easier. We want to help you get insurance that fits your needs. You can get more information about our products and services by calling our agency at (409) 945-4746. Get your free quote today by CLICKING HERE.

Disclaimer: The information presented in this blog is intended for informational purposes only and should not be considered as professional advice. It is crucial to consult with a qualified insurance agent or professional for personalized advice tailored to your specific circumstances. They can provide expert guidance and help you make informed decisions regarding your insurance needs.