Flooding can strike with little warning—and when it does, the aftermath can be devastating. Even a few inches of water can cause thousands of dollars in property damage, and homeowners are often left wondering how they’ll recover. Many assume that government disaster aid will cover the costs, but the truth is, flood insurance and federal assistance work very differently—and they often complement each other rather than overlap.

Understanding how these two forms of protection work together can help you make better financial and recovery decisions, especially if you live in a flood-prone coastal area like Texas City, Texas.

Understanding Flood Insurance

Flood insurance is a specialized policy that provides financial protection against damage caused by flooding—something standard homeowners or renters insurance doesn’t cover.

In most cases, flood insurance is purchased through the National Flood Insurance Program (NFIP), which is managed by FEMA. Some private insurers also offer flood policies, but the NFIP remains the most common source for homeowners in flood-risk zones.

What Flood Insurance Covers

A standard NFIP policy offers two primary types of coverage:

1. Building Property Coverage

Covers damage to the physical structure of your home, including:

- Foundation, walls, and roof

- Electrical and plumbing systems

- Appliances like water heaters, furnaces, and built-in dishwashers

- Permanently installed carpeting and cabinets

2. Personal Property (Contents) Coverage

Covers personal belongings such as:

- Furniture, clothing, and electronics

- Curtains, rugs, and smaller appliances

- Portable air conditioners and microwaves

Note: Flood insurance usually does not cover temporary housing, vehicles, or items stored outside the home.

Why Flood Insurance Is So Important

Flooding is one of the most common natural disasters in the United States, yet many homeowners are unprepared. Just one inch of floodwater can cause more than $25,000 in damage.

If you live near coastal or low-lying areas—like Texas City, Texas—you’re especially vulnerable to hurricanes, tropical storms, and heavy rainfall events that can lead to severe flooding.

Flood insurance:

- Provides guaranteed coverage regardless of federal disaster declarations

- Pays claims faster than federal aid (usually within weeks, not months)

- Offers peace of mind knowing you’re financially protected before disaster strikes

How Government Aid Works After a Flood

Government disaster aid, typically managed by the Federal Emergency Management Agency (FEMA), becomes available only after a Presidential Disaster Declaration.

While this assistance can be helpful, it’s important to understand its limitations:

Types of Government Aid

1.Grants:

- Small amounts of money to cover temporary housing or emergency repairs.

- Usually do not exceed a few thousand dollars per household.

- Do not have to be repaid, but are not designed to restore your home completely.

2.Low-Interest Loans (through the SBA):

- Offered by the U.S.

Small Business Administration (SBA) to homeowners, renters, and businesses.

- Must be repaid with interest, though rates are typically lower than private loans.

- Can help cover rebuilding costs, replacing belongings, or repairing property damage.

3.Temporary Housing Assistance:

- Covers rent or hotel costs if your home is uninhabitable after a disaster.

- Short-term and limited in scope.

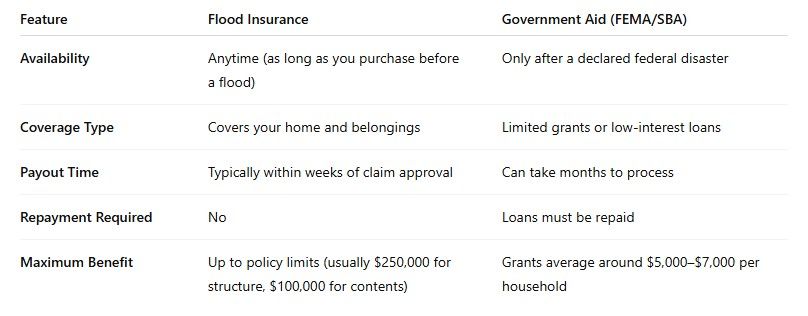

Flood Insurance vs. Federal Aid: Key Differences

How They Work Together

Flood insurance and government aid aren’t competitors—they’re complementary safety nets. In fact, FEMA often encourages homeowners to carry flood insurance because it reduces reliance on federal aid.

Here’s how they can work hand in hand:

- Immediate Recovery: Your flood insurance can provide funds quickly to begin repairs.

- Supplemental Assistance: If losses exceed your coverage or certain costs aren’t covered (like temporary housing), FEMA or SBA programs can fill the gap.

- Future Protection: After a disaster, maintaining flood insurance may make you eligible for additional assistance or improved recovery options.

Example:

A homeowner in Texas City, Texas, files a flood claim for $75,000 in damage. Their NFIP policy pays for repairs, while FEMA provides a small grant for temporary housing during reconstruction.

Who Benefits Most from Flood Insurance

Flood insurance is beneficial for:

- Homeowners in coastal or flood-prone areas (like along Galveston Bay or nearby Texas City)

- Renters who want to protect their personal belongings

- Businesses with valuable inventory or equipment in flood zones

- Homeowners with federally backed mortgages in high-risk flood areas (where insurance is required by law)

Even if you’re outside a designated flood zone, you’re still at risk—nearly 25% of all flood claims come from moderate- to low-risk areas.

Tips for Coordinating Flood Insurance and Government Aid

- Purchase flood insurance early. There’s typically a 30-day waiting period before coverage takes effect.

- Document all damages. Take photos, keep receipts, and file claims promptly.

- Apply for FEMA aid if needed.

Even if you have flood insurance, FEMA assistance can supplement uncovered costs.

- Stay informed about updates. Both the NFIP and FEMA periodically adjust coverage limits and assistance programs.

- Work with a local insurance agent. Agents familiar with Texas City, Texas, can help tailor coverage based on your property’s flood risk and local building requirements.

The Bottom Line

Flood insurance and government aid serve different—but equally important—purposes. While FEMA aid can provide short-term relief, flood insurance is your most reliable long-term protection against the financial impact of a flood.

For homeowners in Texas City, Texas, where severe weather and coastal flooding are real risks, having both resources available can make recovery faster, smoother, and more secure when disaster strikes.

At Brad Spurgeon Insurance Agency Inc., we aim to provide comprehensive insurance policies that make your life easier. We want to help you get insurance that fits your needs. You can get more information about our products and services by calling our agency at (409) 945-4746. Get your free quote today by

CLICKING HERE.

Disclaimer: The information presented in this blog is intended for informational purposes only and should not be considered as professional advice. It is crucial to consult with a qualified insurance agent or professional for personalized advice tailored to your specific circumstances. They can provide expert guidance and help you make informed decisions regarding your insurance needs.