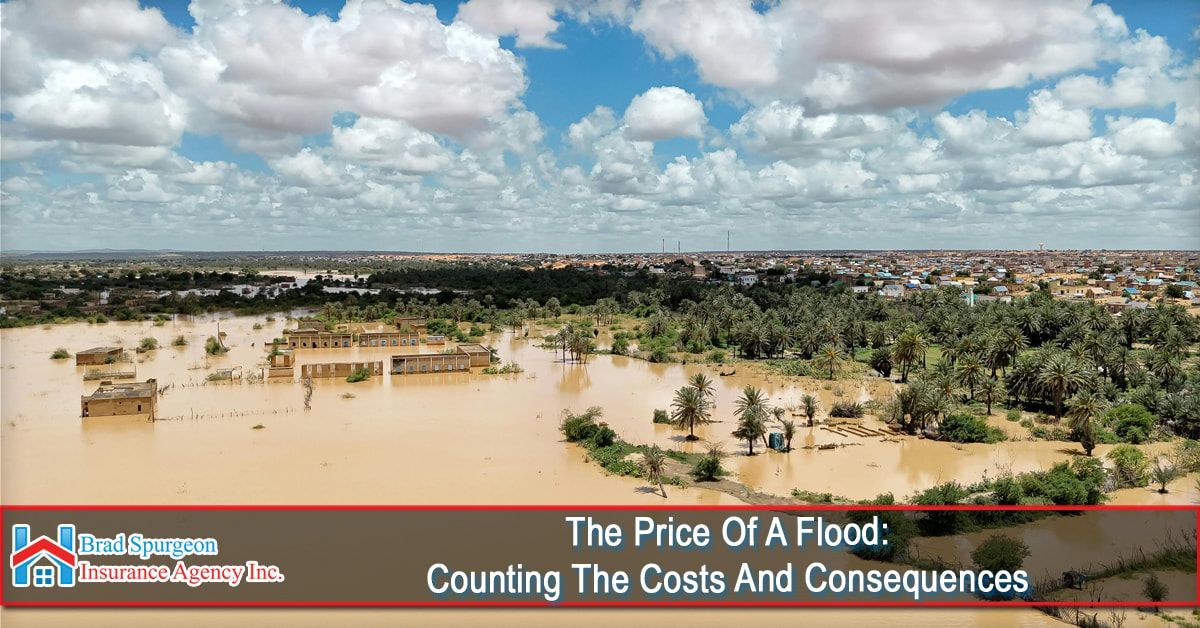

Floods are among the most common and costly natural disasters in the United States. From flash floods caused by heavy rain to storm surges along coastal areas, the damage left behind can be devastating—not just to property but also to finances, emotional well-being, and community infrastructure. Understanding the real costs of a flood and preparing accordingly is essential for any homeowner, business owner, or community planner.

- Structural repairs (walls, flooring, electrical systems)

- Replacing furniture and appliances

- Mold remediation and cleaning

- Temporary housing during repairs

- Loss of personal belongings and valuables

And beyond the physical costs, there's the emotional toll—the stress of displacement, the challenge of navigating insurance claims, and the disruption to daily life.

Flood damage isn’t limited to homes. It can interrupt local businesses, shut down schools, damage public infrastructure, and cause supply chain delays. Businesses in flooded areas may experience weeks or months of downtime, leading to lost revenue, layoffs, and even permanent closure. For homeowners, property values can drop dramatically, especially if the home is in a high-risk flood zone.

Why Flood Insurance Matters

Many homeowners mistakenly believe that their standard home insurance policy covers flood damage—it does not. Flood insurance is a separate policy and is the only way to be financially protected against losses caused by flooding. Offered through the National Flood Insurance Program (NFIP) and private insurers, flood insurance can cover the cost of repairing or replacing your home and its contents after a flood. Without it, homeowners are left to cover all repair and replacement costs out-of-pocket, often relying on limited disaster assistance or loans. Considering the increasing frequency of extreme weather events, having flood insurance is not just a precaution—it’s a critical part of protecting your home, savings, and peace of mind.

While floods can’t always be prevented, preparation can significantly reduce their impact. In addition to having flood insurance, homeowners should:

- Elevate electrical systems and appliances

- Install sump pumps or drainage systems

- Keep valuables and important documents in waterproof containers

- Know local flood zones and evacuation routes

Conclusion: When the Water Recedes, the Bills Remain

The aftermath of a flood is overwhelming, both emotionally and financially. And while recovery takes time, the financial burden doesn’t have to fall entirely on your shoulders. Understanding the risks, counting the true costs, and having the right protections in place—like flood insurance—can make all the difference when disaster strikes.

At Brad Spurgeon Insurance Agency Inc., we aim to provide comprehensive insurance policies that make your life easier. We want to help you get insurance that fits your needs. You can get more information about our products and services by calling our agency at (409) 945-4746. Get your free quote today by CLICKING HERE.

Disclaimer: The information presented in this blog is intended for informational purposes only and should not be considered as professional advice. It is crucial to consult with a qualified insurance agent or professional for personalized advice tailored to your specific circumstances. They can provide expert guidance and help you make informed decisions regarding your insurance needs.